How SME’s can strategically manage IP during economic events (Step 2)

This is Part 2 of a 8 step series on how SME’s can strategically manage IP during economic events.

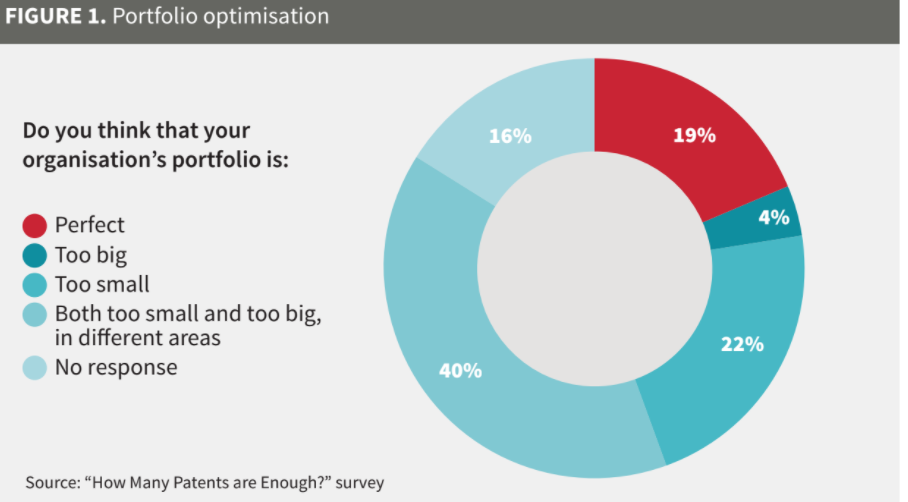

A 2020 study from IP analytics firm Aistemos and IAM magazine noted businesses spend $40B on annual portfolio maintenance, but only 19% of firms believe they have the right portfolio. For many firms having difficult times, an IP budget is often one line item to be scrutinized – and given the majority of companies not having the correct optimization, it is clear this is one area to focus on.

Step 2: IP Budgeting

In order to maximize value while ensuring cost control through budgeting it is critical for any firm to have a detailed view of their IP assets first, which can be done via an IP Audit (Step 1). Once an detailed IP asset view is understood, budgeting can be done with a much deeper insight into which assets to continue to support, and which can be scrutinized in more detail.

There are at least 2 IP budgeting exercises for a firm to consider implementing: Budget by time, and foreign filing budgeting. A SME experiencing cash flow constraints can apply these exercises to their portfolios to enable c-suite business discussions on where to continue IP funding, where flexibility exists, and where potential IP cash generation exists in divestment or licensing opportunities.

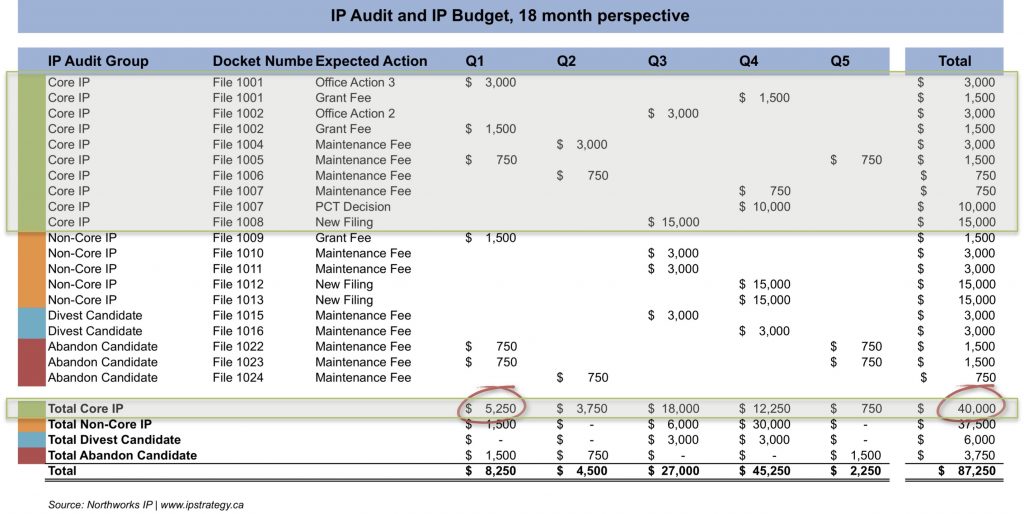

Budget by Time: Reviewing and planning IP budgets should be considered against multiple time frames. For patents, it is recommended to approach budgeting in a 3, 6, 12, and 18 month time frame, or at least 5 business quarters. This allows for planning and decision making for a longer R&D cycle (new patents), as well as patents in prosecution (upcoming and expected foreign filing decisions). As well, budget items need overlaid with the “IP Asset priority” that was categorized in the earlier IP Audit. Using patents as an example, the combination of the IP Audit priority groups laid over this extended timeline provide a detailed picture with respect to the following costs:

In this example, a SME with a annual $85,000 patent budget can reduce “Core IP” costs to under 50%, but this reduction is done with a longer term understanding of where expenses will arise, and where reductions can occur. For C-suite discussions the Budget x Audit table demonstrates where costs are critical to still fund, where flexibility exists in reducing fees, or where potential capital generation exists in divestment opportunities.

Foreign Filing: In addition to budgeting by time, foreign filings should be budgeted for from the perspective of country decisions on at least a 12-18 month cycle. In practice, making decisions on an ad-hoc basis as PCT or nationalization extensions arise over a 12 month cycle may put a company in the position where non-core patent extensions are approved early on in the year and core patent extensions at the end of the year are not actioned due to cost considerations. However, having foreign filing decisions, such as PCT decisions, done in this longer time frame allows insight into critical foreign extensions that will require budget allocation in the future.

Other IP Assets

Registered IP: The above example is specific to patents, but the same approach can be applied to trademarks and other registered assets.

Non-registered IP: Other IP, such as data sets or specific trade secrets identified during the IP Audit should also be flagged during an IP budget review to ensure resources on protecting these assets are still maintained. For example, SME’s with a heavy emphasis on trade secrets as their Core IP need to ensure overall budget changes in the SME that have an impact on staffing reduction are flagged to the C-suite. This will ensure appropriate actions are taken to ensure maintenance of the trade secret (i.e., staff reduction may require now a transfer of know-how before key staff leave, or review of exit interview processes to ensure departing employees are aware of their trade secret and IP obligations). The recent high profile trade secret theft by a Google employee as he moved to Uber highlights the importance of managing and monitoring trade secrets during employee departures.

SMEs will need to ensure IP assets that do not typically appear on a budget sheet as a cost are still considered so steps can be taken to ensure IP rights are managed and maintained.

Moving forward

If almost 80% of firms do not feel they have the right portfolio size, this highlights there is tremendous opportunity to right-size a budget to focus on corporate value.

For those SME’s not experiencing cash flow issues this exercise provides a way to streamline budgets and ensure they are focusing on efficient use of funds.

For SME’s experiencing short term cash flow issues can utilize this approach to understand which critical assets need maintained, which may be optional to consider divesting or abandonment, and which have expenses that can be deferred for a later quarter.

Up next in Part 3, applying IP audit and IP budgeting to streamline IP operations (both IP talent and operational resources)