How SME’s can strategically manage IP during economic events (Step 4)

This is Part 4 of a 8 step series on how SME’s can strategically manage IP during economic events: Strategic prosecution repositioning

The key to successfully managing strategic IP prosecution during economic challenges relies on an understanding of “what specifically” you IP actually protects and has the opportunity to protect, not just a general understanding that IP may apply to your business once the patents grant in the future.

Targeted patent prosecution with IP and business intent is usually not the status quo…. but should be.

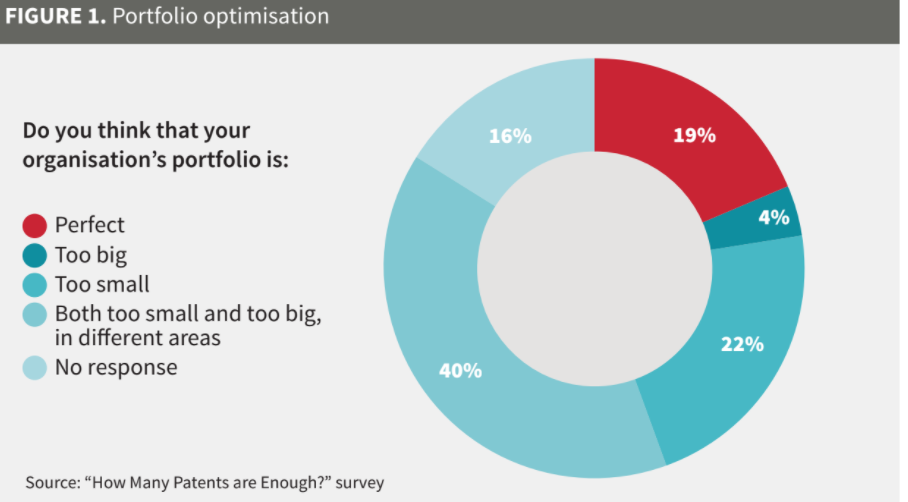

Research (and personal experience) indicates only about 5% of a typically patent portfolio is the value of the portfolio as a whole. This, coupled with the Aistemos and IAM magazine research indicating only 19% of firms believe they have the right portfolio, suggests refocusing prosecution may be one tangible way to ensure value can be shown in a portfolio when pressure to control costs are being mandated.

But how can SME’s practically enable prosecution repositioning for value, which is reserved for open applications?

As a first action, there are 4 technology positions that need mapped out:

- Company technology offering (today)

- Company technology offering (future)

- Market technology needs (now, future)

- Key competitors technology position (now, future)

The end result will be a technology map of the company’s technical direction, key competitors direction, and market direction – similar to what the organization would need or use for strategic planning but used in this case for IP needs.

As a second action, both in-prosecution claims AND specification support need understood and overlaid with the above to illustrate where coverage is – more importantly where coverage is missing but there is opportunity to reposition claims.

Based on this the following types of patents will emerge to be acted on, which becomes the basis for prosecution repositioning:

- New opportunities: Applications where claim scope can be expanded via prosecution changes or divisionals, giving new claims to leverage market or competitively relevant specification support.

- Repositioning: Applications where claim support falls outside competitive or market use, but can be revised in prosecution to better match protection.

- Abandonment / Divestment: Applications where claim support falls outside

competitive or market use, and return on continued investment is low. This may even include applications once thought “core” because the scope was meant to cover a “core” technology, but the review suggests otherwise.

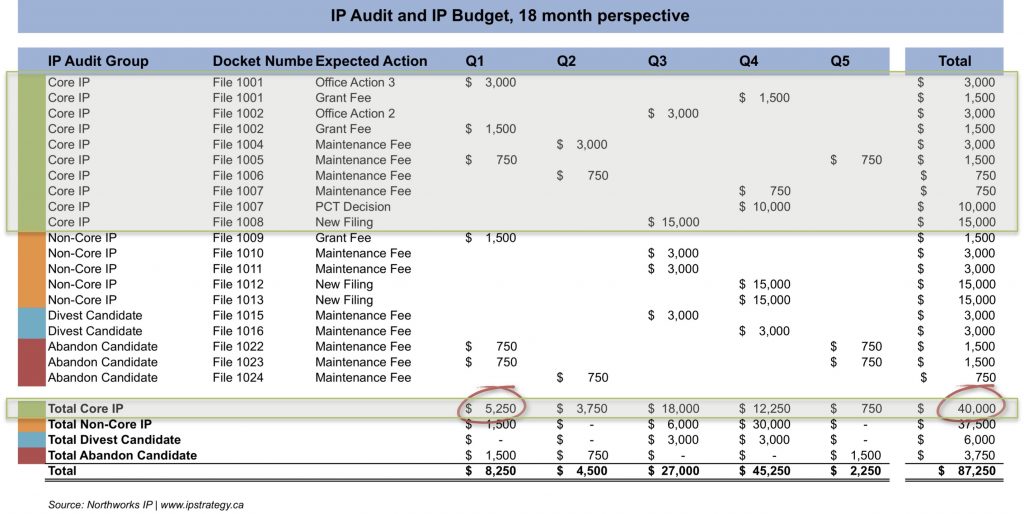

For larger portfolios this can be a tremendous amount of effort, but has the potential to generate a high return on investment by focusing key patents and also flagging patents for divestment or abandonment that were once thought core. IP leaders can begin to prioritize efforts by referring back to Step 1 and Step 2, as outcome of the IP Audit should have categorized the patents into virtual priority levels or groups to begin with (Core, non-Core, Divest, and Abandon groups at minimum).

There is little difference between this approach to prosecution than firms actively focusing claims for enforcement in an industry or against a specific competitor. Claim charts may not be necessary, but the though process in strategic prosecution repositioning can be considered the same.

Moving forward

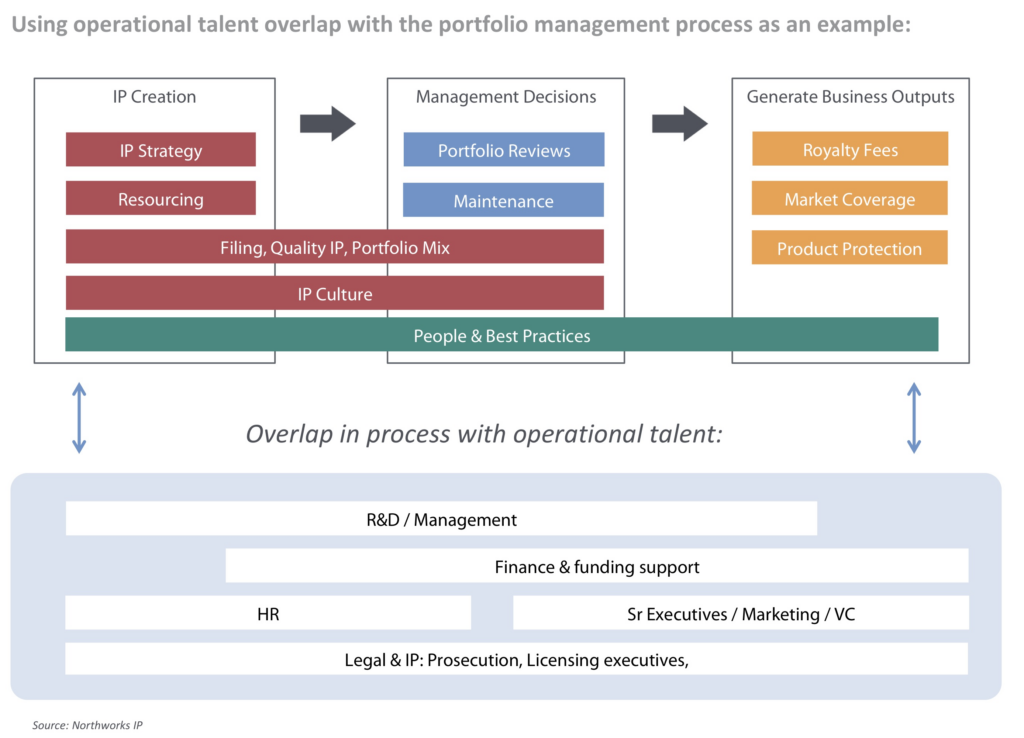

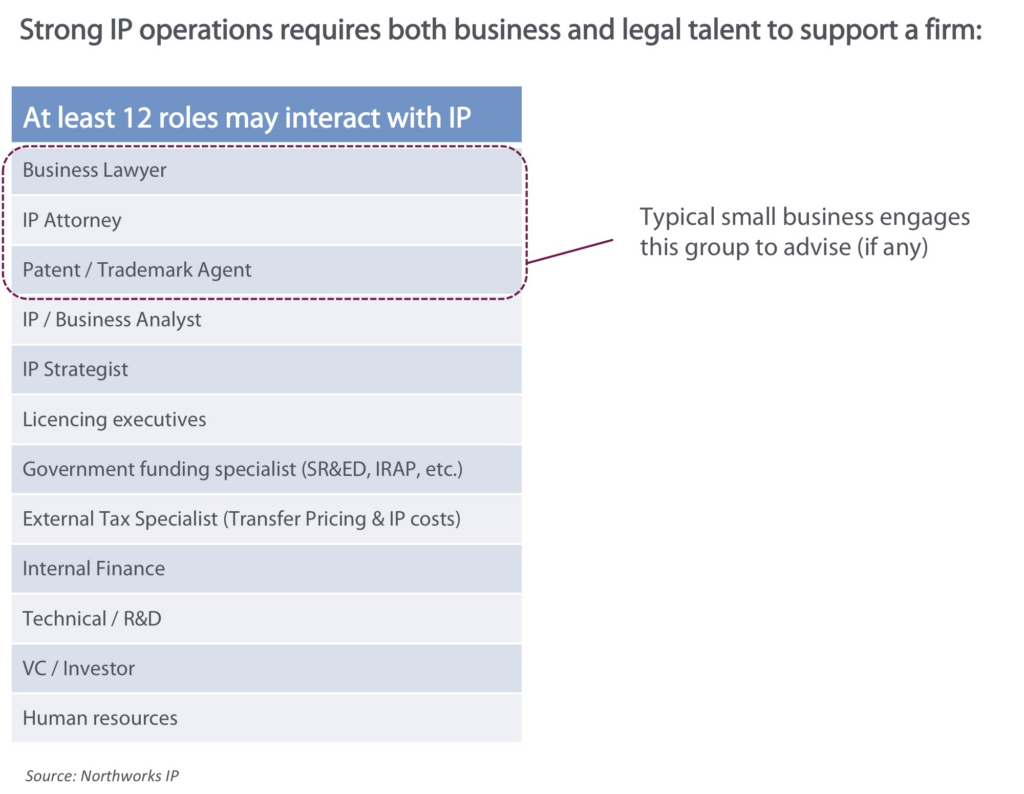

A useful patent strategy still needs to have real market applicable patents that can be used to at least defend, license, or enforce. In-prosecution repositioning will build on the IP Audit (Step 1) and budgeting (Step 2) outcomes, and when mixed with IP operational updates (Step 3) will help focus in a cost efficient manner a portfolio for relevant commercial use by the business.

For firms in tough economic times this approach can not only help rightsize the portfolio for today but also ensure the protected technology scope matches with company needs in the future. The end result has the potential to be a focused patent portfolio with higher intangible value and lower cost to prosecute and maintain.

Up next in Part 5, applying IP audit, budgeting, and operations thinking into portfolio repositioning so business risk through contractual reviews can be properly assessed.